Our holistic approach towards the Sanjaynagar Slum Rehabilitation Project got us involved in finding a financial solution for the homeowners to make their contribution, which revealed the struggles faced by marginalised groups to access formal credit. Our team, along with our social partner Snehalaya and peer-to-peer lending platform Rang De worked together on a home loan product for the residents of Sanjaynagar. We are sharing our learnings from this Financial Inclusion model in 3 parts. In part 1, Shashank Mittal from our team shares an overview of the situation in India and a summary of our work in Sanjaynagar.

Housing Finance for Economically Marginalised Groups

It is estimated that 26–37 million families belonging to the Economically Weaker Section (EWS) and Low-Income Group (LIG) in urban India live in informal housing in poor conditions (Source: IDR). In the absence of market-led solutions, various housing schemes by the state and central governments including the Pradhan Mantri Awas Yojana (PMAY-Urban) have attempted to solve for the housing problem for these groups. However, access and affordability of housing finance remains a key challenge for low-income communities.

Housing Finance Companies (HFC) and Affordable Housing Finance Companies (AHFC) are non-banking financial companies (NBFC) whose principal business is to finance the acquisition or construction of homes. Challenges such as clear land titles, ownership documentation (that makes the property mortgageable), proof of income etc. make it difficult for LIGs to access housing credit even through the AHFCs. Home-improvements are therefore typically financed through small credit from microfinance institutions (MFIs) and local money lenders. About 60% of a poor person’s assets are represented by their home. Enabling investment in housing can thus be a significant path forward to enable the social and economic advancement of economically marginalised households.

Situation at Sanjaynagar

Sanjaynagar is a vibrant and close-knit community, with many residents living here since the early 1980s. Most are informally employed, working as daily wagers, or running small retail businesses. Income and expenses are made in cash, and most families can only spend what they earn on a daily basis.

A majority of the households in Sanjaynagar have 1 or more family members with bank accounts, mostly Jan Dhan accounts. Very few, however, have the know-how and experience of dealing with banks. Some young men in the community have borrowed from banks and financial institutions to purchase motorcycles, mobile phones etc., but these are only a handful. Some women in the community have borrowed from MFIs by forming groups in the past. Even so, it would be hard to call them financially literate and within the fold of formal financial institutions. Most do not have proper documentation of their previous loans and have little to no understanding of interest rates at which they borrowed.

Given the context of the community, all the banks and HFCs we engaged with declined to extend housing finance to the residents of Sanjaynagar. Reasons given were either a long checklist of documents that the community could not fulfil, or their categorization as high-risk and capital-intensive borrowers.

Unique Loan Product

We knew of Rang De as a unique peer-to-peer lending platform, with a social objective of making affordable credit available to those who do not have access to institutional credit from banks and rely on more predatory sources like local moneylenders. Together, we ideated on a housing loan product which would allow the residents of Sanjaynagar to not only borrow funds to build their own but also help them build a credit history and become eligible for formal loans in the future.

Salient features of the Unsecured, Peer to Peer Lent, Home Loan from Rang De:

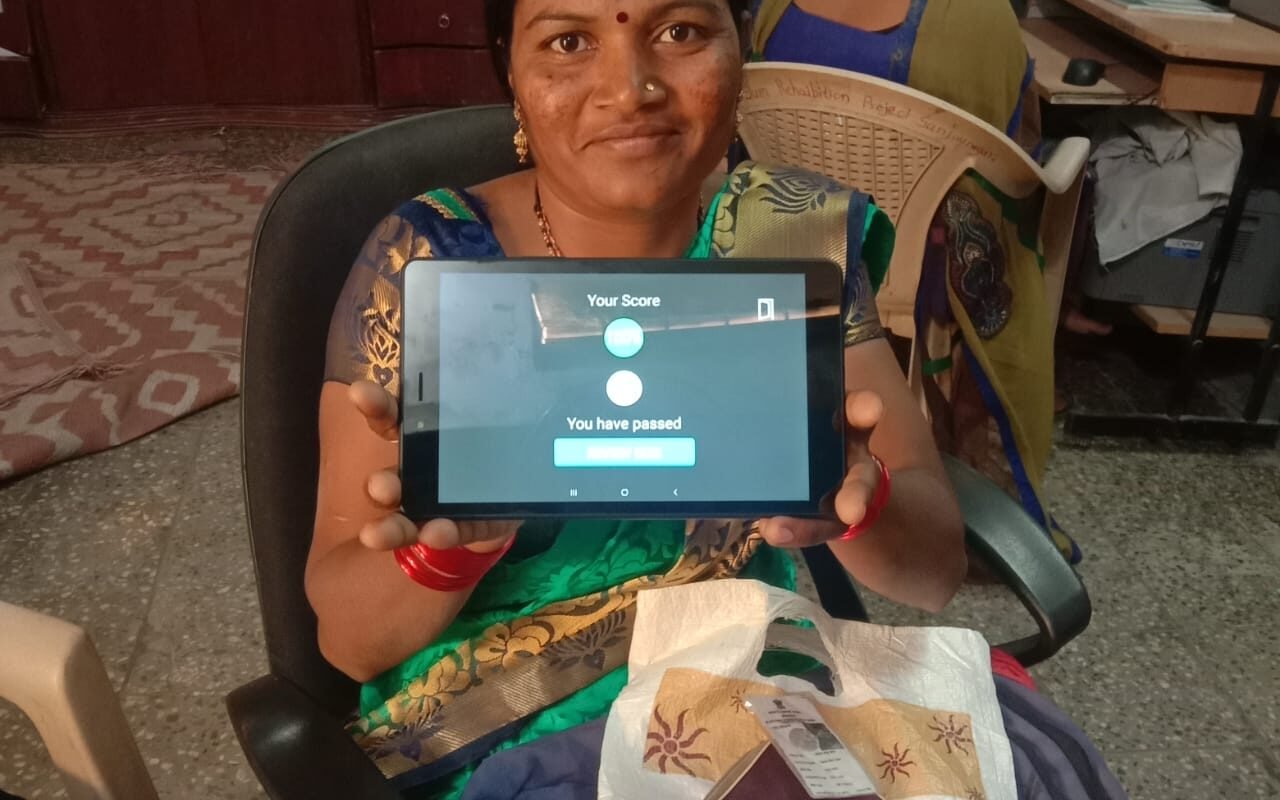

- Mandatory Financial Literacy Training: 3-4 hours (covers key financial concepts such as domestic financial planning, saving, basic banking, borrowing etc).

- Assessment: MCQ type assessment based on the topics covered in the financial literacy sessions.

- Maximum amount per borrower: Rs. 1 lakh

- Tenure: 12-36 months (Though still much shorter that typical tenures for housing finance, this was a middle path taken, keeping in mind Rang De’s model, the income levels of the residents of Sanjaynagar and their monthly repayment capacity)

- Rate of Interest: 5.5% simple (9.9% APR)

- Repayments: Monthly

- Mode of Repayment: Direct Transfer to Unique Escrow Account set up for each borrower

- Building of credit history and score